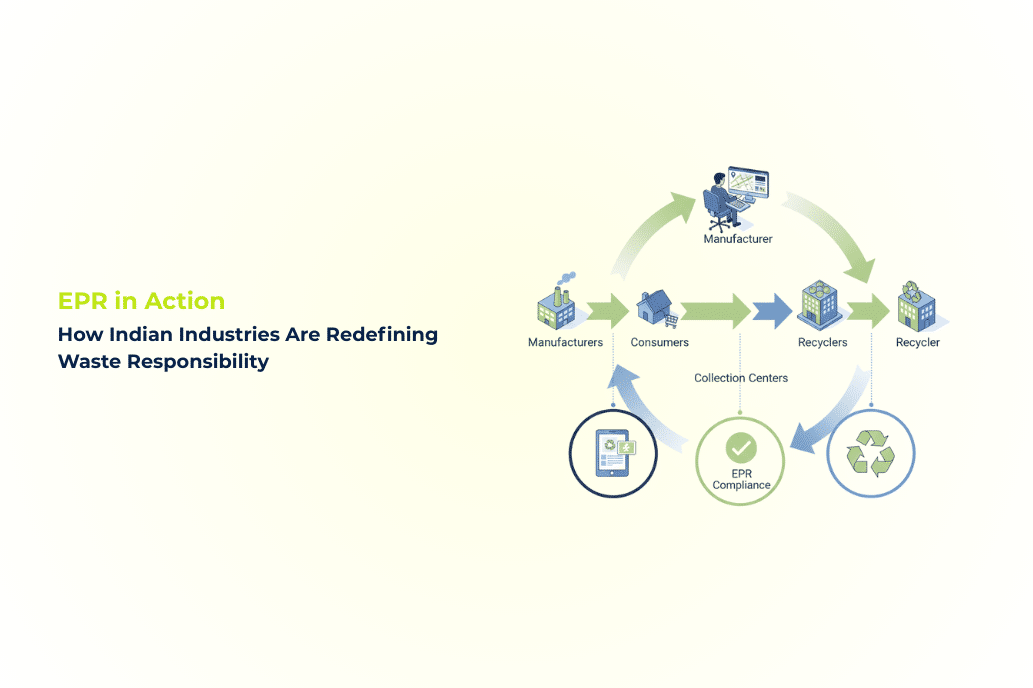

Extended Producer Responsibility used to be a compliance checkbox. Now it has become a competitive advantage. What’s interesting is that India’s manufacturing and scrap ecosystem including scrap buyers, sellers, aggregators, refurbishers, and recyclers are no longer sitting on the sidelines. They’re actively shaping how waste is collected, processed, and monetised.

The shift began when companies realised that EPR isn’t about paperwork. It’s about building a responsible supply chain that tracks material flows, increases recyclate quality, and strengthens circular manufacturing. As a result, industries across automotive, FMCG, electronics, metals, and construction are rethinking everything; from how they buy scrap online to how they partner with old scrap buyers near me who can ensure traceability and compliance.

The New Mindset Driving EPR

Businesses have started seeing three clear wins:

- Cost savings from reclaimed raw material rather than volatile virgin material prices.

- Better ESG performance, which directly influences investor trust.

- Predictable waste flows, enabling long-term contracts with trusted scrap buyers and recyclers.

What this really means is, companies that once viewed waste as a liability now see it as an asset.

EPR compliance in 2025 has completely changed the way plastic recyclers, aggregators, and scrap traders operate. For years, recyclers stayed behind the scenes, working quietly as informal suppliers of recycled plastic. That era is over. Producers need certified recyclers more than ever, and the ones who can issue clean documentation, maintain traceability, and guarantee recycling capacity are becoming the strongest players in the chain.

The key shift in 2025 is that producers must meet higher recovery targets. Some categories have jumped by 15 to 20 percent. And they can’t meet these targets on their own. They need recyclers who can handle verifiable tonnage, provide digital evidence, and maintain compliance records. This is where the real opportunity opens for recycling businesses.

Certified recyclers who maintain transparent operations now command better pricing because their recycling certificates (EPR credits) are in extremely high demand. Producers need clean paperwork, and they’re willing to pay a premium for recyclers who run proper MRF setups, documented bale movement, and batch-wise processing. Even aggregators who previously operated informally are now formalising their businesses, registering on EPR portals, and building partnerships with authorised recyclers to meet demand.

case that demonstrates this shift involved a recycling firm in Gujarat that handled around 150-180 tons of LDPE and PP waste per month. After EPR tightening, two large FMCG brands approached them directly. Not for scrap supply, but for assured monthly recycling capacity with traceability. The recycler invested in basic digital tracking, hired a compliance manager, and standardised bale marking. Within one year, their monthly revenue jumped nearly 40 percent because they began supplying EPR credits in addition to selling recycled pellets. The work didn’t change much, just the level of documentation did. But it led to the increase in market value.

A Real Example from the Field

A leading automotive OEM recently redesigned its EPR model by building a network of certified scrap buyers and dismantlers across five states. Here’s what they achieved within one year:

- Recovered 28 percent more usable metal from end-of-life vehicles.

- Reduced procurement cost of certain alloy components by 15 percent.

- Enabled sellers and scrap yards to register on their scrap register system for transparent scrap purchase.

- Digitally tracked every batch movement from generator to recycler, improving compliance accuracy by 40 percent.

This wasn’t luck, it was the result of a disciplined, data-backed EPR transition. Today EPR in India is becoming more practical and execution-driven because industries are focusing on:

- Reverse logistics designed for scrap rather than consumer returns.

- Material-specific buyback programs (plastic, metal, rubber, glass, copper, mixed scrap).

- Digital scrap purchase platforms enabling bulk industry waste to flow to registered recyclers.

- Verified old scrap buyers near me ensuring last-mile collection from SMEs and industrial estates.

Sorted scrap exchange models, helping sellers get fair pricing through transparent bidding.

India’s industrial EPR ecosystem is evolving fast. Over the next three years, we can expect to see:

- AI-based scrap grading integrated directly into factory collection points.

- Blockchain traceability for plastic, metal, and e-waste to validate compliance and prevent fraud.

- Industry clusters running shared EPR obligations through cooperative collection centers.

OEM–scrap yard partnerships becoming the backbone of circular manufacturing.

And here’s the thing: businesses that build robust EPR practices early will dominate the scrap value chain later.

Key Takeaways for Scrap Buyers, Sellers, and Recyclers

If you’re in the scrap ecosystem, this shift is an opportunity, not a hurdle. Here are some TO-DOs which you can include in your process :

- Register on scrap platforms to increase visibility for scrap purchase contracts.

- Offering digital proof of collection, dismantling, and recycling, it boosts trust.

- Standardize your material grading and pricing formats.

- Build long-term relationships with producers exploring circularity.

- Focus on compliance-ready operations; EPR-linked businesses prefer assured partners.

The future belongs to those who can align compliance with operational excellence.

FAQ

- How does EPR benefit scrap buyers and recyclers?

It increases demand for verified partners, boosts material volumes, and ensures steady long-term contracts. - Can small scrap sellers participate in EPR models?

Yes. Registered sellers and small yards are essential to building localized collection networks. - What materials fall under EPR responsibility?

Common categories include plastics, metals, electronics, rubber, automotive parts, and packaging waste. - How can industries ensure transparent scrap purchase?

By using digital platforms that record collection, movement, and recycling data end-to-end.