Traceability used to be something only auditors cared about. Today, it’s the backbone of how modern waste management works, especially for India’s fast-growing scrap ecosystem. Manufacturers now demand full visibility of where their waste goes, who handles it, how it’s processed, and whether it genuinely reaches a compliant recycler. And for scrap buyers, sellers, and recyclers, this shift is rewriting the rules of business. If the scrap industry wants to compete at a global level; whether in scrap purchase, selling scrap online, or managing industrial waste,etc. Transparent tracking is no longer optional. It’s the only way to build a circular economy that functions at scale. Here are some reasons showcasing why traceability has become non-negotiable

Indian industries are pushing aggressively towards circular manufacturing, and several forces are driving this:

- Rising EPR obligations across plastics, electronics, metals, and packaging.

- Industries demand audit-ready documentation for every scrap-related transaction.

- Investors prioritising ESG reporting with real-time waste data.

- Reduced tolerance for informal routing or unverified old scrap buyers near me.

- Manufacturers using more secondary materials and wanting quality assurance.

In short, businesses don’t just want their waste collected; they want it tracked, verified, and certified.

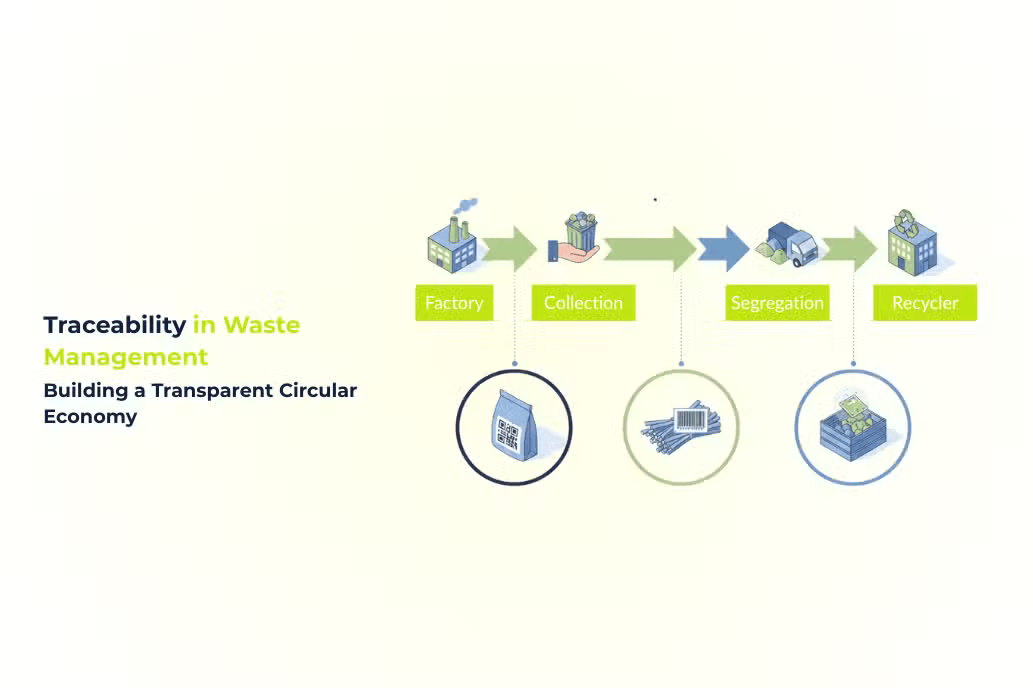

Traceability looks different theoretically and it’s different on ground level. A mature traceability system in waste and scrap management usually includes:

- Digital scrap register IDs assigned to every batch leaving a factory.

- QR-tagged material receipts scanned by buyers and transporters.

- GPS-enabled vehicle tracking during movement from generator to scrap yard.

- Photo-based proof of loading, segregation, and recycling.

- Automated weight and purity logs, uploaded directly by scrap buyers.

- Recycling certificates linked to each scrap ID, ensuring end-of-life transparency.

For waste generators, this means reliable proof. For scrap buyers and sellers, this means trust. For recyclers, it means consistent supply.

A Realistic Industry Example: When Traceability Changes Everything

In 2024, a major India-focused FMCG conglomerate (one of the top three in packaged foods) rolled out a centralised traceability program for its multilayer plastic and mixed-metal scrap. Instead of depending on dozens of small informal collection agents, the company built a verified network of:

- certified scrap buyers,

- dismantlers,

- and recyclers across eight states.

Within 12 months, the results were dramatic:

- Traceability improved from 44 percent to 96 percent.

- Leakage of scrap to informal networks reduced by 82 percent.

- Scrap purchase cycle reduced from 9 days to 36 hours.

- Material recovery improved by 21 percent at partner recyclers due to better segregation.

- Recycled output met quality benchmarks for 15-20 percent substitution of virgin plastic in packaging trials.

This led to the biggest shift wherein, scrap buyers who adopted digital documentation and transparent reporting became the company’s preferred long-term partners, securing multi-year contracts and predictable volumes. This is the new competitive advantage in the Indian scrap industry.

Lessons From Other Industry Examples

- Automotive OEMs and Metal Scrap Tracking

A well-known passenger vehicle manufacturer implemented RFID-tagged bins for stamping scrap and aluminium offcuts. Impact:

- Scrap purity differences dropped by over 30 percent.

- Buyers gained clearer grading information and were able to bid more accurately.

- Recyclers received cleaner input, reducing cost of pre-sorting.

2. Electronics Companies and E-Waste Segregation

The top three smartphone brands in India adopted QR-based waste maps across service centers. Impact :

- E-waste traceability increased to 98 percent.

- Old scrap buyers near me were replaced with verified dismantlers who provided digital proof-of-destruction.

- Recyclers improved metal recovery yields by 12–14 percent.

3. Metal Recyclers and Real-Time Tracking

A Gujarat-based ferrous recycler created a digital scrap register system to track inbound mixed scrap from 400+ MSME suppliers. Impact :

- Payment disputes fell by 60 percent.

- Sellers gained confidence through transparent grading.

- Bulk scrap purchase volumes from industries increased significantly.

These examples show the same pattern that when material flows become transparent, value increases for everyone in the chain. Traceability isn’t an added step, it is the foundation of professional scrap management.

-

Traceability Benefits for Scrap Buyers, Sellers, and Recyclers

- Scrap Buyers

- Gain trust from large industries due to verifiable documentation.

- Secure long-term scrap purchase contracts.

- Command premium rates for transparent operations.

2. Scrap Sellers

- Sell scrap online with proof-based pricing.

- Reduce disputes thanks to uniform grading and photographic evidence.

- Receive faster payments due to audit-ready trails.

3. Recyclers

- Get sorted scrap with minimal impurities.

- Streamline operations with predictable volumes.

- Build strong compliance credentials for global clients.

The Future of Waste Tracking in India

Over the next few years, India will see major upgrades:

- Blockchain-enabled scrap certificates

- AI-driven, real-time scrap grading

- Common digital scrap registers across industrial zones

- Predictive supply-demand dashboards for recyclers

- Integrated EPR + traceability platforms

This is how the scrap industry evolves into a core pillar of the circular economy in India—making the system more transparent, accountable, and globally competitive.

FAQ’s

- What makes traceability essential for waste management?

It ensures that every scrap batch is verifiable from origin to recycling, reducing leakage, fraud, and quality issues. - How do small scrap dealers benefit from traceability?

They gain credibility, better pricing, and access to major industrial clients who require compliance-ready partners. - What technologies support scrap traceability?

QR codes, batch IDs, GPS tracking, AI-based grading, digital scrap registers, and automated reporting systems.

4. Does traceability increase scrap purchase cost?

No. In fact, it reduces hidden losses, prevents rejections, and often results in more competitive and transparent pricing.